Nice Tips About How To Reduce Cash Conversion Cycle

Envision the opportunities you can claim more quickly with.

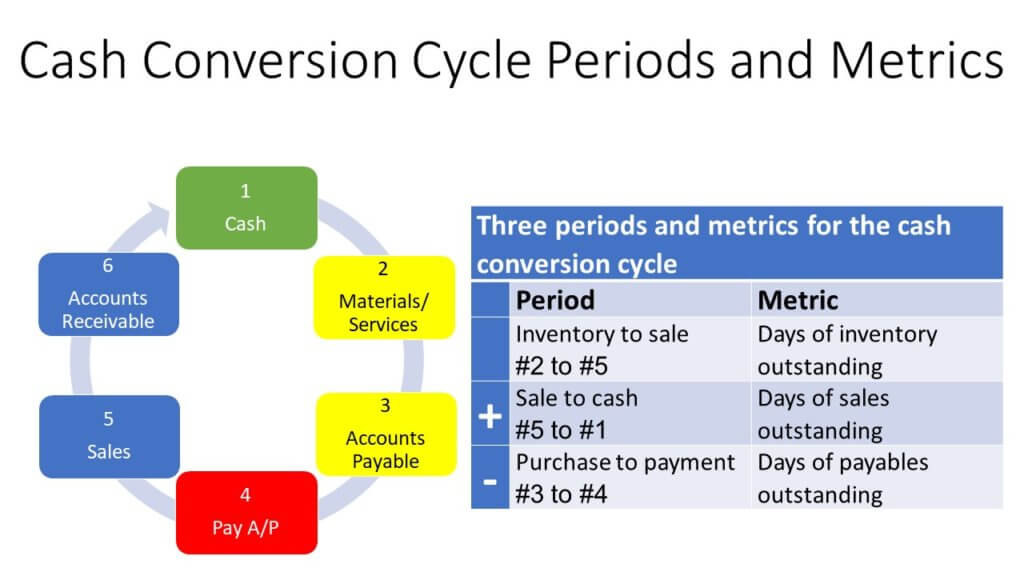

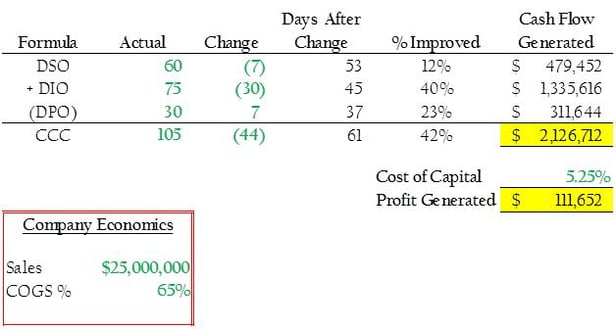

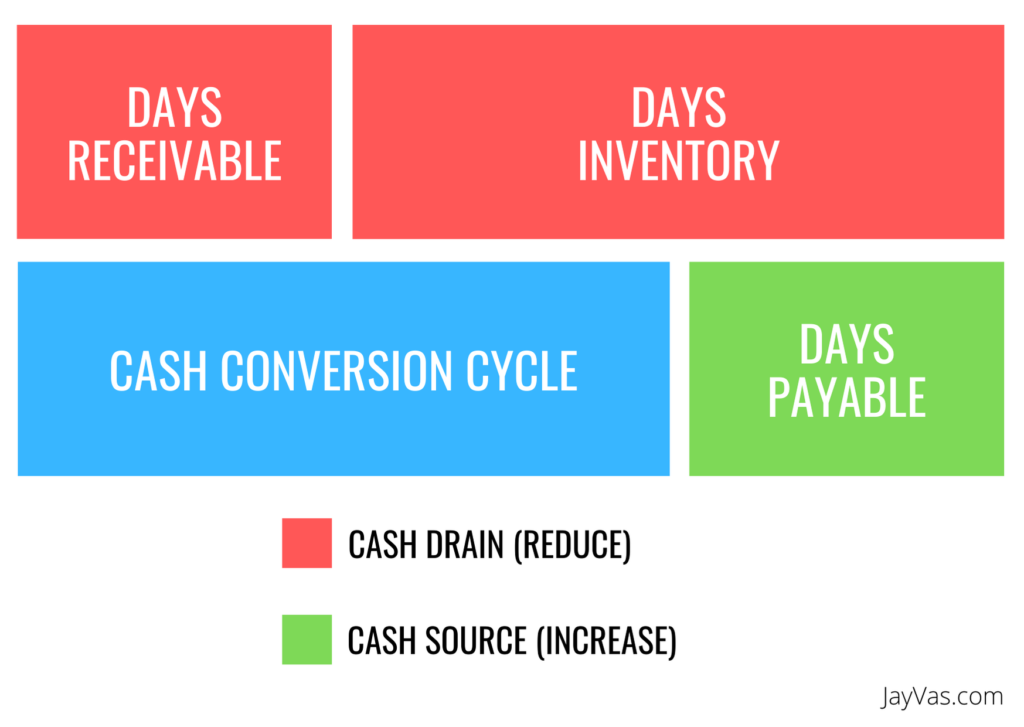

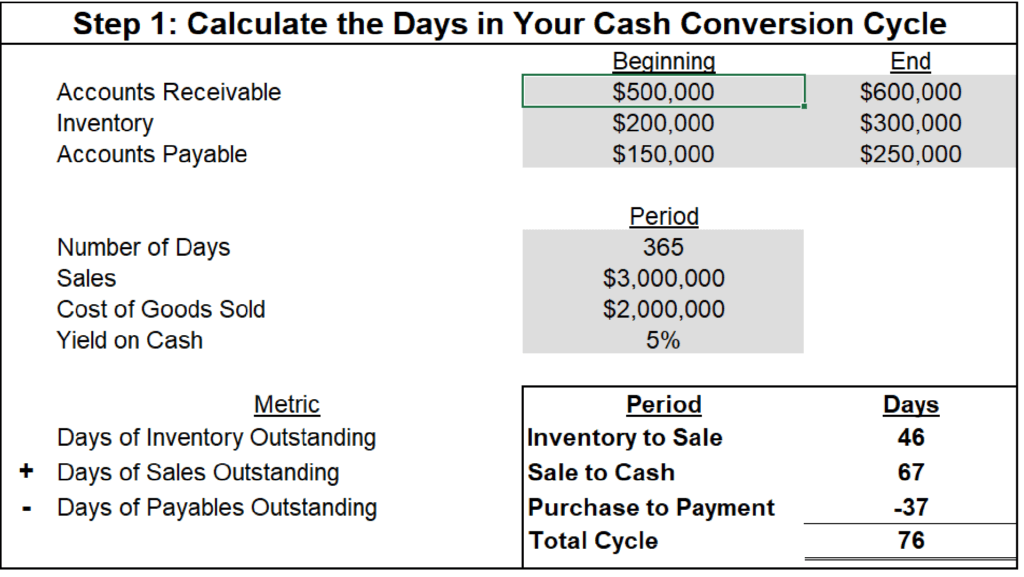

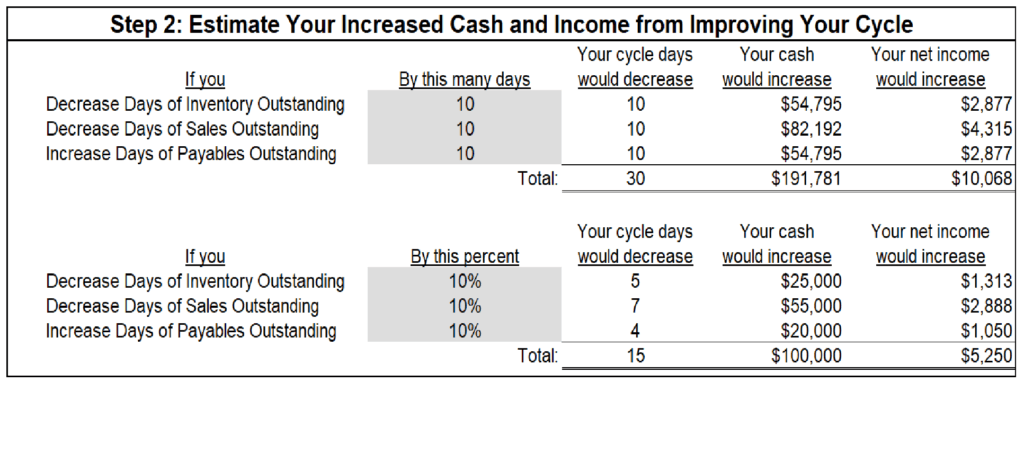

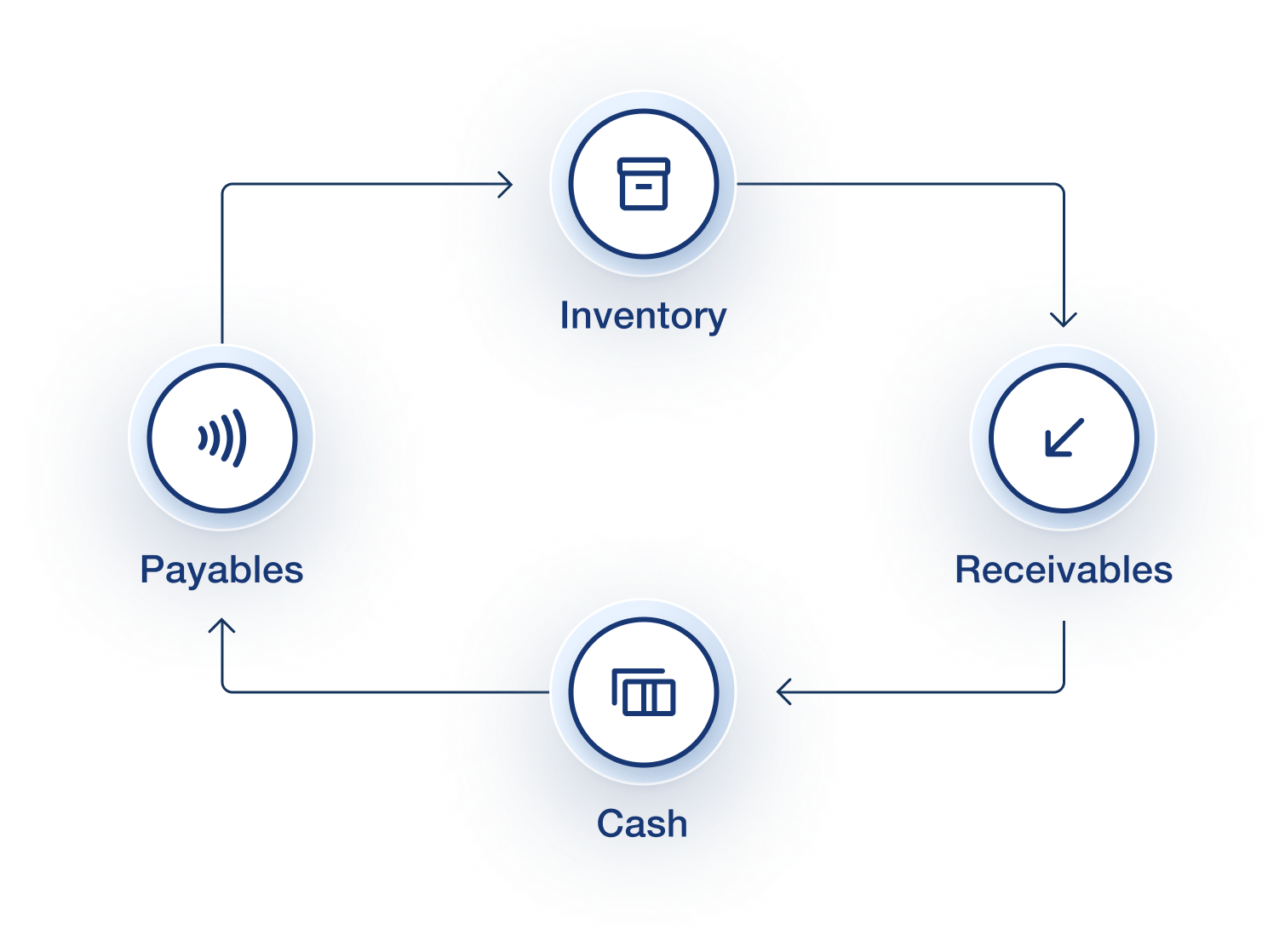

How to reduce cash conversion cycle. Using the example above, if abc inc. Here are four steps for. To the extent that you can effectively manage your cash conversion cycle, you can reduce your need for external borrowing or raising more equity capital.

This will depend on how well. If your cash conversion cycle is too high, you may consider negotiating with your suppliers to extend payment terms. Eliminate excess inventory inventory that sits for a long time before being sold prolongs the cash conversion cycle, tying up cash so it is unusable to the business.

Inventory management happened to be the key factor in the. How do we interpret it? You can also request longer payment terms from suppliers.

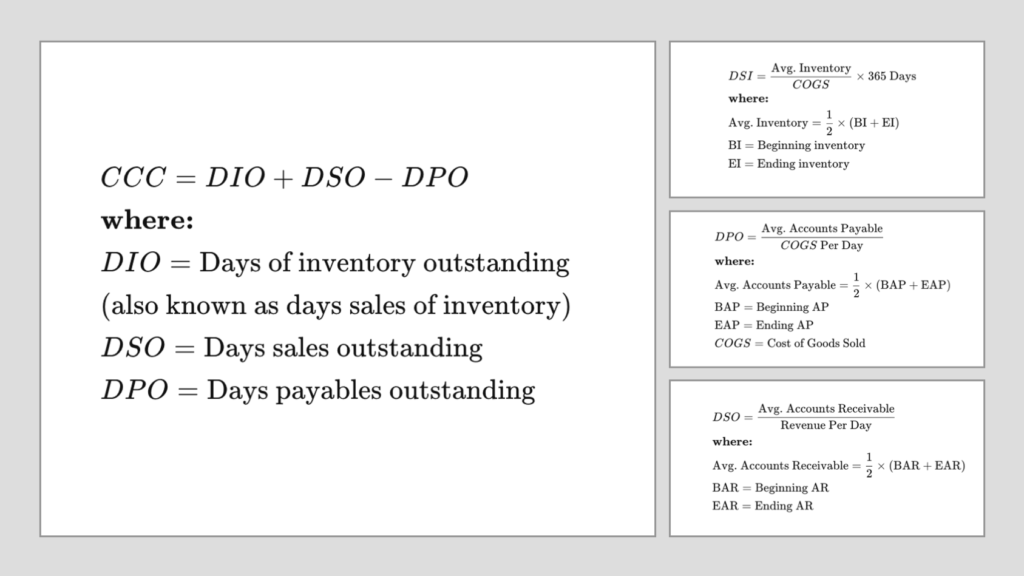

Imagine not needing to borrow money to cushion yourself while customers scrape their invoice payments together. 5 tips to shorten the cash conversion cycle improve cash flow management. Formula of cash conversion cycle.

Here are some of their top suggestions to keep in mind: Keeping better tabs on why things change over 24 hours. We can break the cash cycle.

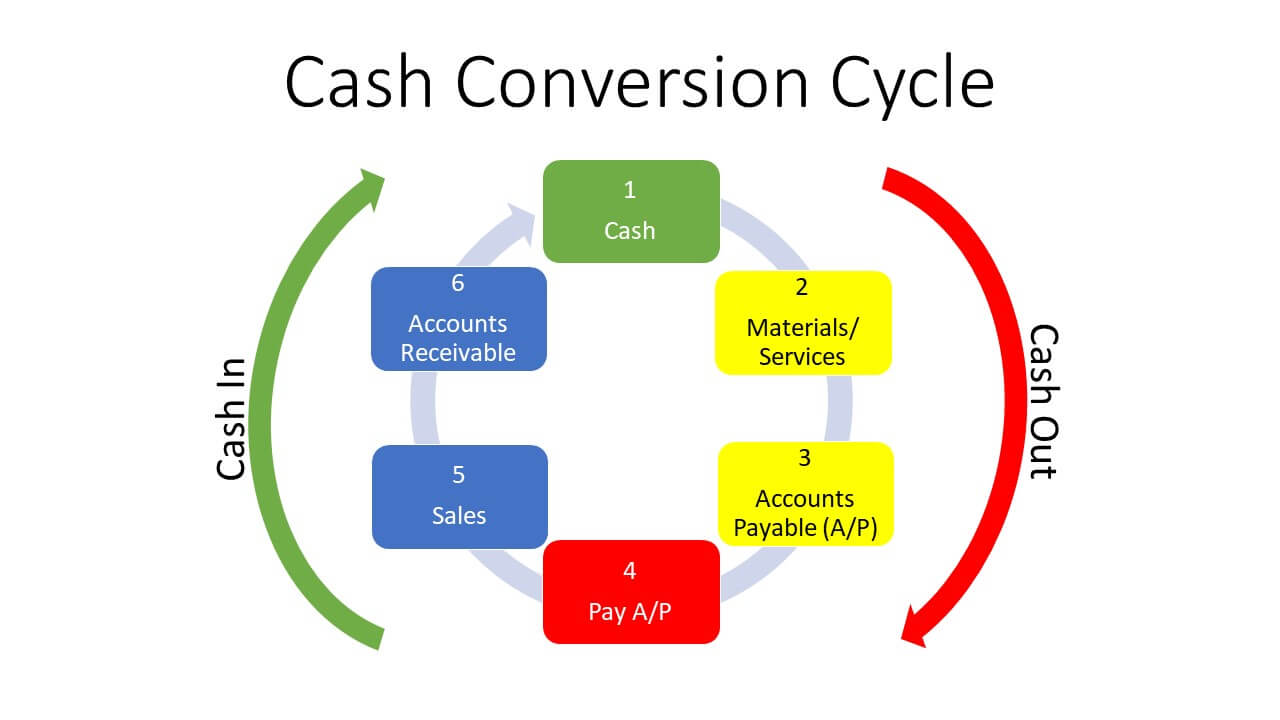

Analyze your cash flow and operations on a daily basis. The cash conversion cycle (ccc) is a metric that expresses the length of time, in days, that it takes for a company to convert resource. If you’re struggling with your cash conversion metrics, getting money in your hands.